Denmark — 9 min

Tax and Compliance — 6 min

As an independent contractor or a small business owner, you are responsible for submitting quarterly estimated tax payments to the Internal Revenue Service (IRS).

But how do you file them — and when? How do you estimate the amounts? And what happens if you miss payments?

In this article, we’ll discuss everything you need to know about these quarterly taxes, so let’s jump straight in.

Quarterly taxes are estimated payments that you must make to the IRS every three months. Instead of receiving a “bill”, you pay an estimate based on how much income you made during that quarter.

By spreading out the payments, you can manage your cash flow more easily.

When you file your annual tax paperwork at the end of the tax year, you will find out whether you underpaid or overpaid on your estimates. If you underpaid, you will need to settle the remainder. If you overpaid, you will receive the difference back as a rebate.

Most people work for an employer, and have their tax withheld from their paycheck. This isn’t the case for self-employed people, who are responsible for calculating, filing, and paying their own taxes.

Therefore, if you’re self-employed, you’ll need to pay quarterly taxes. Self-employed individuals include:

Sole proprietors

Independent contractors

Anyone who is part of a business partnership, like an LLC

Anyone who manages a company independently, regardless of whether it’s gig or part-time work

Other entities that may be required to file quarterly include:

Investors receiving dividend income or capital gains

Employees who are not paying enough tax

S-corporation shareholders

Landlords earning rental income

Bondholders receiving interest income

Writers earning royalties

If you receive taxable unemployment benefits, retirement benefits, or any Social Security benefits, you may also have to pay estimated taxes.

The IRS uses a few “safe harbor” rules to determine if you need to make estimated tax payments every quarter.

Under these rules, you should pay quarterly taxes if:

You’re an employee and you anticipate owing more than $1,000 upon filing your tax return, even after deducting withholding and tax credits, or;

Your tax credits and withholdings are expected to be less than:

90% of the present year’s anticipated tax amount

100% of the tax debt from the previous year (if it covers all 12 months of the year)

If, come filing time, your adjusted gross income is over $150,000 (or $75,000 if you’re married and filing jointly), the requirement increases from 100% to 110%. Those who make at least two-thirds of their income from farming or fishing are exempt from this rule.

You must pay either two-thirds of the current year’s tax, or all of your tax from the previous year. You must also pay your estimated taxes on January 15 of the following year, although you don't have to make estimated tax payments if you file and pay your taxes in full by March 1.

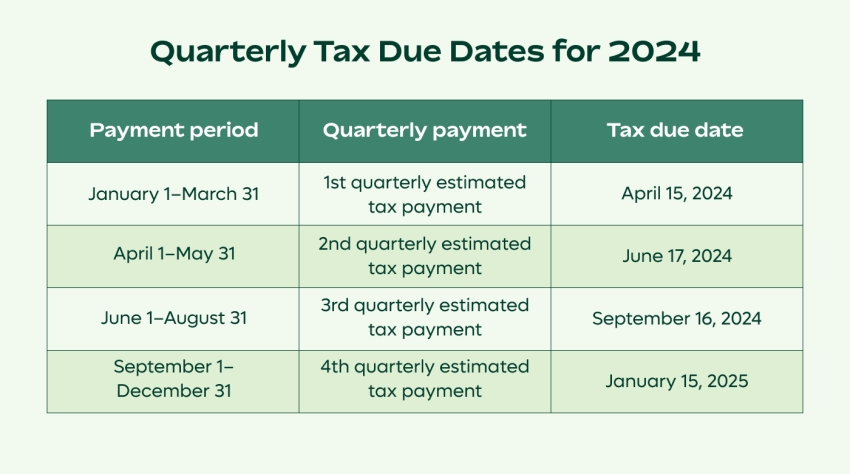

Your estimates must be settled by the end of each quarter. The deadline dates are confirmed by the IRS each year.

In 2024, for instance, the deadlines for payments are April 15, June 17, September 16, and January 15, 2025.

Note that if you pay the full amount due with your 2024 annual tax return and submit it by January 31, 2025, you will be exempt from making the January 15 payment.

It’s also important to note that, while the estimates are quarterly, the actual payments can be made more regularly. For example, some independent contractors prefer to make 12 smaller payments instead of three larger ones.

The IRS often gives those affected by natural disasters — like floods, hurricanes, and wildfires — more time to file and pay their taxes. If such a disaster affects you, check the IRS website for disaster relief announcements.

If you’re required to make quarterly payments, missing the deadlines can be expensive. You will be fined and charged interest if you don’t pay on time, and the longer you go without paying, the more fees and interest you will have to pay.

These penalties depend on how much you owe and how late your payments are, and increases proportionately with the payment periods you miss.

In most cases, the IRS will immediately levy a late penalty equal to 0.5% of the amount due. This penalty will increase by 1% for each subsequent month you don’t pay, up to a maximum of 25%.

However, the penalty may not be imposed if:

An accident, disaster, or other unusual event led to the underpayment

You retired or became disabled during the tax year (or the previous year), and the underpayment was not willful neglect

If your income fluctuates throughout the year, try to figure out your annual income and then estimate how much you should pay per quarter.

You can use either Form 2210 or Form 2220 to determine whether you must pay a penalty for underpaying your estimated taxes.

Your quarterly tax liability can change based on your income, your filing status, the tax year, and your deductible expenses.

To determine your estimated taxes, use the IRS’s Estimated Tax Worksheet, which is found in Form 1040-ES for individuals. This worksheet will show you how to calculate quarterly taxes and give you payment vouchers.

Here are the general steps involved in estimating your quarterly taxes:

Obtain your proof of income during the estimated tax period, including any business receipts, pay stubs, and 1099 forms. Then, estimate your yearly income and any deductions that might apply to calculate your taxable income.

When calculating your income, don’t forget to make the necessary deductions for retirement contributions, health insurance, and any other applicable deductions.

Use Form 1040-ES to calculate your likely tax liability, factoring in income tax, alternative minimum tax, self-employment tax, and tax credits. Then, multiply your taxable income by your tax rate.

Divide this total number by four to see how much your quarterly payments will be. You can also divide this total by 12 to see what your monthly payments would be.

The IRS provides multiple payment methods. You can pay with a debit card or a bank account, via cash or check, or through the IRS2Go app. You can also pay by phone through the Electronic Federal Tax Payment System (EFTPS).

Paying quarterly taxes four times a year (or more) might seem like a lot of work. However, spreading these payments out can actually be beneficial, helping you even out your cash flow and avoid interest charges. That’s why it’s important to stay on top of this requirement.

With Remote’s Freelancer Hub, you can keep tabs on your quarterly taxes by tracking invoices and managing all of your documents in one place.

To learn more about how we can help you stay compliant — as well as manage clients, organize invoices, and get paid — check out Freelancer Hub for free today.

Sign up with Remote for locally compliant contract templates and simple payments at just $29 per month, with no hidden fees.

Subscribe to receive the latest

Remote blog posts and updates in your inbox.